Scott McKnight is a Ph.D. student in political science at the University of Toronto. His research focuses on government-business relations, with particular focus on China’s strategic industries. Having lived in China for six years, he is fluent in Mandarin, and has conducted field research on China’s energy-related investments in various countries.

Abstract

The energy sector seems like a natural meeting ground for deeper China-Canada cooperation. After all, Canada is a major producer and exporter of crude oil, while China is the world’s largest importer of crude oil. But a handful of obstacles prevent greater energy cooperation. First, without the export infrastructure to send crude and natural gas elsewhere, nearly all of Canada’s oil exports go to the United States. Second, although deep-pocketed Chinese national oil companies (NOCs) poured more some US$40 billion into Canada’s energy sector between 2005-2015, many of these investments are under-performing, hamstrung by operational issues, regulatory delays and low prices.

This paper examines the obstacles that have curbed NOC profitability in the oil sands and have thus obstructed deeper energy-based cooperation between Canada and China: 1) low energy prices and high production costs in the oil sands; 2) regulatory hurdles and contradictory policies; 3) lack of infrastructure, especially pipelines to tidewater; 4) fallout from the power struggle in the Chinese Communist Party (CCP), which includes the purging of executives tied to investments in the Canadian oil sands. As a result, Chinese NOC investment behaviour now places greater emphasis on returns and efficiency as well as integrating assets, as opposed to merely acquiring as many reserves as possible. Overall, these obstacles have made Canada’s oil sands less appealing to capital-rich Chinese NOCs. While the golden era of China feasting on assets in Canada’s oil sector seems behind us, it is still too early to call China’s energy shopping spree a bust because profit horizons in the oil sands need to be measured in decades, not years.

Keywords: Oil, tar sands, Canada, China, SOEs

1.1. Why Chinese NOCs have “gone out”

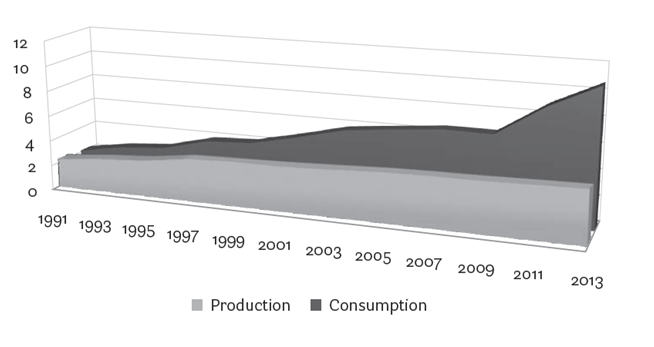

China’s rising oil demand shows no sign of levelling off. Between 1997 and 2015, China’s oil demand nearly trebled, from 4.2 million to over 11 million barrels per day (bpd) (Figure 1). Meanwhile, oil imports into China have skyrocketed, from 1 million in 1997 to over 7 million bpd in 2015.1 China is now the world’s largest importer of oil (Figure 2). By 2030, China’s oil demand is projected to be 16.6 million bpd, with imports accounting for three-fourths of total demand at 12.5 million bpd—a far cry from when the country was a net exporter until 1993.2 Most disturbing for security-minded Chinese leaders, China’s economy simply cannot grow without a steady supply of oil. And for China’s leaders, continued economic growth is vital to social stability and the CCP’s hold on power.

Figure 1: China’s Oil Production & Consumption, 1991-2003

(Millions of barrels per day)

Figure 2: “Achievements” in China’s Rising Oil Demand

The hydrocarbon shopping spree undertaken by China’s national oil companies (NOCs) is more than just about assuaging fears among China’s political leadership. But for these NOCs—China National Petroleum Corporation (CNPC) (中石油), Sinopec (中石化), and China National Offshore Oil Corporation (CNOOC) (中海油)—perhaps more important is the NOCs’ push for greater profits (Figure 3). For one, every barrel worth of oil pulled out of the ground and sold is one taken off their asset sheets—a challenge faced by all oil companies, private and state-owned; therefore, China’s NOCs need to continuously acquire new reserves to replace depleted ones.

Figure 3: Who are China’s NOCs?—An Overview

Part of the problem is that China, despite being among the world’s top five in crude output (Figure 4), is actually oil-poor—relative to its staggering size and soaring demand, that is. China’s domestic reserves account for just over 1% of the world’s proved oil reserves; its proved natural gas reserves are even less. Why China’s NOCs are “going out”3 to purchase exploration and production assets abroad can be explained by the political imperative of satisfying leadership demands—after all, these NOCs are state-owned—but more importantly, to diversify and grow their reserves of oil and natural gas. Understandably then, Chinese NOCs have especially targeted the upstream sector, the most profitable part of the oil business.4

Acquiring quality exploration and production assets abroad hasn’t been easy for China’s NOCs, who are relative latecomers to the game, having first started to purchase overseas assets in the early 1990s. As a result, these NOCs have ended up the proverbial leftovers, where costs and political risk tend to be high—whether in Libya, Venezuela, Ecuador, Sudan-South Sudan or Iraq. Here is where Canada’s unique combination of vast reserves, private ownership and political stability appears like a natural draw for capital-rich Chinese NOCs to make major investments.

1.2 Canada’s Oil Sector from 30,000 Feet

Canada produced about 4.4 million barrels per day (bpd) of petroleum and other liquid fuels in 2014, good enough for fifth most output among countries (Figure 4). That’s an increase of over 300,000 bpd over the previous year, despite investment-curtailing decreases in crude prices.

Figure 4: Top producers of crude oil and natural gas (millions bpd)

Oil production in Canada comes from three main regions: 1) the oil or “tar” sands; 2) the larger Western Canada Sedimentary Basin (WCSB); and 3) the Atlantic ocean, primarily offshore Newfoundland and Labrador.5

Since 2003, when oil sands resources were deemed technically and economically recoverable, oil sands production has grown steadily year-over-year.6 By 2014, oil sands production accounted for more than half of Canadian crude oil output. At the centre of Canada’s oil industry is the province of Alberta, which accounted for 78% of Canada’s oil production in 2014. About 81% of the province of Alberta’s total crude oil production came from the oil sands.7 Alberta’s major oil sands deposits are located in three main deposits: the Athabasca, Cold Lake and Peace River (Figure 5).

Figure 5: Major Deposits in the Oil Sands

These deposits account for the lion’s share of Canada’s proved reserves, which combined with the rest of the country’s are third highest in the world. Unsurprisingly, virtually all of Chinese NOC investments have taken place in the oil sands. But the NOCs are not alone. The high technical demands of production in the oil sands has required a diverse group of super-majors, majors and independents to specialize and focus on particular regions and tasks.8

Although Canada is a significant oil exporter, almost of its crude exports go to the United States because Canada does not have the export infrastructure to send its liquids elsewhere (see section 2.3). With the United States (again) becoming the world’s largest crude producer in 2015—which necessarily will result in sharp declines in demand for Canadian oil and natural gas—Canada now needs to find alternative trading partners for its growing output of crude. This is where energy-hungry yet energy-poor east Asia comes in. But the problem with Canada’s diversification wish—and Chinese NOCs who are tied to it—is not so much about getting the oil out of the ground as it is about getting it from the oil sands to the Pacific coast.

1.3 What Happened to “Our Chinese Oil Sands”? 9

Canada’s oil sector features a unique combination of vast reserves, private ownership as well as overall political and macroeconomic stability. A wide variety of oil companies—domestic and foreign, large and small, many private but some state-owned—participate in Canada’s energy sector. The oil sands, which finally became commercially viable in the early 2000s as a result of rising oil prices and technical advances, require vast sums of capital to fully exploit their potential. Between 2005 and 2015, deep-pocketed Chinese NOCs collectively shelled out nearly US$40 billion in oil sands projects, shale developments and buying stakes in domestic companies. In 2004, Chinese capital made up less than 1% of Canada’s total foreign direct investment (FDI) in the energy sector; by 2013, it was 9%.

Things have cooled considerably since then. Many of these Chinese NOC plays have under-performed, hamstrung by operational issues, infrastructure bottlenecks and low prices. Are Chinese NOCs facing buyer’s remorse?10 Chinese NOCs—the oil sands’ fastest-growing source of capital—have hit the brakes, with whispers of some trying to get out altogether through possible asset swaps. However, with low oil prices and the investment outlook in the oil sands bearish, Chinese NOCs find themselves in the unenviable position of having bought high and selling low.

A bit of levelheadedness is needed here. Oil sands projects, by virtue of their complex nature, require long-term horizons in which profitability is best evaluated in decades, not years. But feeling the heat from political masters in Beijing and stockholders—which, for state-owned enterprises like NOCs, pressure from the former surely more unsettling than from the latter—has forced Chinese NOCs to be more selective in their plays, focusing more on efficiency, integrating assets and return-on-investment—rather than simply buying as many energy assets as possible. This paper examines the obstacles that have limited NOC profitability in the oil sands, and thus have hindered greater energy-related cooperation between China and Canada.

2. NOCs in the Tar Sands: Buyers’ Remorse or Wait-and-See?

2.1 Low Prices, High Costs

We’re now in an era of low oil prices (see Figure 7 for reasons). While there is no universal break-even price for oil sands production, the scale ranges from about US$95 per barrel (especially for new pit mining projects) to around $80 per barrel (for in-situ new projects).11 With oil likely to stay in the range of US$50-60 a barrel for the rest of the decade, this isn’t good news for the capital-hungry yet high-cost Canadian oil sands.

Figure 6: Some reasons for low oil prices

Sustained low prices have led to investment cutbacks. Many Canadian oil firms have already undergone corporate restructuring, with some proposed projects scrapped altogether. Total capital expenditure across the Canadian oil sector was estimated to have fallen by one-fifth in 2015, though that number is a tad exaggerated because of the record-setting US$56 billion spent in 2014.

Chinese NOCs have joined in the belt-tightening. It was reported that CNOOC, the Chinese national oil company that led the contentious takeover of struggling Nexen in 2012, sought to slash expenses in 2015 by one-third. This was part of CNOOC’s broader effort to write down US$842 million in overseas assets, mostly in high-cost production regions like North America and the North Sea.12

A few issues unique to the Canadian oil sands may make a rebound more uncertain: first, the longer time-lags due to the complex geology of production areas; second, as a product of the first, the higher production costs and greater degree of technical sophistication needed to exploit the oil sands’ resources13; third, the political deadlock surrounding pipeline expansion (see Section 2.3), which could open up Canadian oil sands production to demand in either the United States or Asia—depending on the pipeline in question. All told, despite low oil prices having curtailed investment, large-scale shuttering of projects is unlikely.

2.2 Investment Canada Act: Red Tape or Needed Regulation?

In the wake of popular backlash to CNOOC’s takeover bid of Nexen in 2012, the Conservative government under Stephen Harper passed the Investment Canada Act, which stipulates that any large investment in Canada must be of “net benefit” to Canada.14 Since then, only a handful of purchases by foreign companies in the oil sands has taken place. The problem with viewing this legislation as having shut the door on acquisitions of controlling interests in the oil sands is that it doesn’t take account of the broader, largely bearish context surrounding the act—most importantly, low oil prices and the global recession.

However much the Nexen deal and the subsequent act have caught headlines—while stinging Sino-Canadian relations—this legislation, designed to limit foreign control of strategic commodities, has actually rarely been used. Perhaps worse than the legislation itself was the contradictory signals coming from the Harper government, which years earlier had been coveting Chinese investment into the oil sands, only later to say that state-owned companies wanting controlling stakes was not welcome. These mixed signals are something the new Liberal government will necessarily have to acknowledge if it’s eager to get investment flowing into the oil sands.

2.3 Infrastructure Bottlenecks: It All Flows South

Virtually all of Canada’s oil exports went to the United States in 2014. Canada simply does not have the export capacity to send its crude or natural gas anywhere else. A handful of export pipelines (see Figure 7) have been proposed with the multiple goals of increasing upstream production in the oil sands, reaching more sophisticated refineries downstream as well as accessing under-served markets.

No pipeline project has gained more attention than the stillborn Keystone XL pipeline, on which the kibosh has been put several times, most recently in November 2015 by presidential order for its apparent negative environmental impacts.15 The other noteworthy one is the Northern Gateway pipeline project, whose supporters see this pipeline to the Pacific as holding the promise of pumping large volumes of Canadian oil to catch higher international prices in high-demand markets in Asia, which would then turn into greater corporate profits for further investment and greater tax dollars for the province of Alberta and federal coffers. That’s part of the story anyway.

Resistance has come from a variety of political opponents, First Nations, and environmental groups. For the latter, the oil sands are a major source of untapped, carbon-intensive crude reserves. The prevailing combination of infrastructural constraints and low oil prices is therefore a great opportunity to keep the oil in the ground.

Figure 7: Existing Export Pipelines

With no immediate hope of relieving these infrastructural bottlenecks just as production from the oil sands continues to increase, the only feasible option is to transport more and more oil by rail. In 2014, rail carried about 140,000 bpd of crude to the United States out of a total of 185,000 bpd—an increase of 172% from the previous year.16 By 2016, Canada is projected to transport up to 250,000 bpd of crude oil by rail. Without the Keystone XL pipeline, estimates for rail shipping rises to 600,000 bpd in 2018, pushing the limits of the rail loading capacity of 776,000 bpd.17 The final chapter of Canada’s pipeline drama has yet to be played out.

2.4 Fallout from Power Struggles in Beijing in NOCs

Chinese NOC investments in the Canadian oil sands haven’t been free from the changing political winds in Beijing. In the summer of 2014, several Canadian-based executives from PetroChina, a subsidiary of the China National Petroleum Corporation (CNPC), were arrested on charges of embezzlement and wrongdoing.18 The investigation was part of a broader anti-corruption drive—and Byzantine power struggle in Beijing—between new President Xi Jinping and political rivals, the most prominent being Zhou Yongkang, whose power base extended deep into the CNPC ranks.

A Chinese government audit, released in June 2014, found that CNPC, one of the world’s largest companies with assets throughout the globe, had “withheld” nearly US$100 million in profits. Xinhua news agency reported that money was used for employee “bonuses” as well as to pay for “extravagant consumption”. Cost overruns, delays, and generally under-performing assets in the oil sands have certainly not helped these executives gain more sympathetic ears in Beijing.

The investigation can be seen as part of a broader theme in the changing power dynamic between China’s powerful state-owned enterprises, of which NOCs are seen to be among the most powerful, and the Chinese party-state. Since undergoing a process of liberalization and decentralization in the early 1980s—part of a broader shift away from central planning to a market economy—the state-company balance of power too has shifted, away from the central government and toward the national oil companies (see Figure 8).

Figure 8: How reforms and decentralization have benefited China’s NOCs

Chinese NOCs have eagerly taken advantage of their growing autonomy and political importance, especially in the wake of exploding profits through the 2000s. But if wealth brings criticism, then the NOCs have had their share of both; Chinese media has consistently criticized the NOCs for acting as a predatory “monopolistic interest group” (垄断利益集团) that puts its own interests above public welfare, which also make them a popular target for new president Xi Jinping looking to consolidate his rule with public support.

Yet for as much as NOCs have used their growing resource base to do their own thing, the Chinese party-state nevertheless controls several levels over which to rein in wayward NOC executives. For one, the State Asset Supervision Commission (SASAC) (国资委) has formal authority over China’s largest state-owned enterprises, NOCs included. In recent years, SASAC linked managers’ salaries to their companies’ financial performance.19 More obviously, though, it is the party-state that has the power to hire, fire and promote the NOCs’ general managers, meaning that NOC managers must balance corporate and party-state interests.

3. Conclusion

With Canada’s abundant oil reserves and China’s rising demand for oil, the energy sector seems like a natural meeting point for greater Sino-Canadian cooperation. But several things must change for this cooperation to occur:

- Clarity: Chinese NOCs, like any foreign company, will have to abide by Canadian laws in the oil sands. But those laws need to be spelled out clearly and need to be seen as legitimate and even-handed, and not the discriminatory product of opportunistic political leaders.

- Sobriety: The under-performance of many of Chinese NOC investments in the oil sands, to a large degree, could not have been predicted, and instead are part of a broader down-cycle in the global oil market. To say that the Chinese were duped overlooks the notoriously risky nature of the oil industry.

- Patience: Chinese NOCs have not been invested in the oil sands long enough to accurately deem their assets as lemons and their shopping spree a bust. Profitability in the oil sands is evaluated in decades, not

- Pragmatism: Whether in welcoming investment from state-owned companies or in facilitating an industry that both generates substantial tax revenues and increases CO2 emissions, energy-hungry markets in Asia need a steady supply of energy. That consistent demand could both be served by Canadian oil and natural gas, and serve to lessen the negative effects of greater carbon-emitting evils like coal-fired power, especially in China and India.

- Flexibility: The era of Chinese NOCs pouring capital into Canada’s oil sands may be over, but it doesn’t mean that investment needs to dry up entirely. There is still interest among Chinese buyers in Canada’s energy sector, but these NOCs now seem more focused on efficiency and return-on-investment.

- Build, don’t just dig: Canada’s leverage as a major energy exporter is deeply limited by its lack of alternative export routes just as the United States is reducing its imports of Canadian oil. A compromise solution between environmental groups, political opponents, First Nations and the oil industry will be needed to get a pipeline built to the Pacific.

A version of this article was first published in Moving Forward: Issues in Canada-China Relations by China Open Research Network (CORN) in open access digital form in January 2016. The content of this article does not represent the positions, research methods, or opinions of the Synergy Editorial Committee. Please address all scholarly concerns directly to the contributor(s) of the article.

Scott McKnight is a Ph.D. student in political science at the University of Toronto. His research focuses on government-business relations, with particular focus on China’s strategic industries. Having lived in China for six years, he is fluent in Mandarin, and has conducted field research on China’s energy-related investments in various countries.

Endnotes

- “BP Statistical Review of World Energy.” BP (2008): 11-20. Web. ↩

- “International Energy Agency.” World Energy Outlook 2008 (2008): 93-102. Web. ↩

- On the “go out” strategy (走出去政策) as it relates to oil, see Zweig, David, and Jianhai Bi. “China’s Global Hunt for Energy.” Foreign Affairs (2005): 25-38. Web. <https://www.foreignaffairs.com/articles/asia/2005-09-01/chinas-global-hunt-energy>. ↩

- The oil and gas industry is commonly divided into three major sectors: upstream (e.g. exploration and production), mid-stream (e.g. transport), and downstream (e.g. refining). ↩

- Canada’s offshore exploration and production is limited by various regulatory and legal constraints. Nevertheless, offshore light crude oil production in the Canadian Atlantic averaged about 220,000 bpd in 2014, accounting for nearly 14% of Canada’s total crude oil production. Canada Association of Petroleum Producers. “Statistical Handbook for Canada’s Upstream Petroleum Industry.” (2015). Web. <http://www.capp.ca/publications-and-statistics/publications/258990>. ↩

- In its natural state, petroleum in the oil sands is found blended with sand, clay, and water. Because of its semi-solid form, exploitation in the oil sands more closely resembles mining operations than traditional oil drilling. ↩

- Alberta Energy Regulator. “ST98-2014 Alberta’s Energy Reserves 2014 and Supply/Demand Outlook 2015-2024.” Web. <https://www.aer.ca/documents/sts/ST98/ST98-2015.pdf>. ↩

- Government of Alberta. “Alberta Oil Sands Industry, Quarterly Update.” (2015). Web. <http://albertacanada.com/files/albertacanada/AOSID_QuarterlyUpdate_Summer2015.pdf>. ↩

- Lunau, Kate. “Our Chinese Oil Sands.” Macleans. Web. <http://www.macleans.ca/economy/business/our-chinese-oil-sands/>. ↩

- “China Faces Buyer’s Remorse in Canada’s Oil Patch.” The Globe and Mail. Web. <http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/china-faces-oil-patch-buyers-remorse/article20090355/>. ↩

- Hussain, Yadullah. “How High Break-even Costs Are Challenging New Oilsands Projects.” Financial Post. 22 Jan. 2015. Web. <http://www.financialpost.com/m/wp/blog.html?b=business.financialpost.com//news/energy/how-high-break-even-costs-are-challenging-new-oilsands-projects>. ↩

- “China’s CNOOC Writes down $842-million in Overseas Assets.” The Globe and Mail. 27 May 2015. Web. <http://www.theglobeandmail.com/globe-investor/chinas-cnooc-writes-down-842-million-in-overseas-assets/article23664537/>. ↩

- There are two main methods of extraction in the oil sands: traditional surface “pit” mining and in-situ underground drilling. When mined at the surface, earth rich in bitumen is transferred into trucks for processing. Historically, surface mining has been the largest source of production in the oil sands, though its share is in what appears to be a permanent decline. By contrast, in-situ extraction pumps steam into underground formations to weaken the bitumen and then pumps it to the surface through wells. Once extracted, bitumen is a heavy, vicious type of crude oil, which then needs to be “upgraded” into a light, sweet low-sulfur synthetic crude oil. For example, see Government of Alberta, “Alberta Oil Sands Industry, Quarterly Update” (Summer 2015), http://albertacanada.com/files/albertacanada/AOSID_QuarterlyUpdate_Summer2015.pdf. ↩

- The largest and most influential provincial regulatory authority dealing with the oil sands is the Alberta Energy Resources Conservation Board (ERCB). The National Energy Board (NEB) is Canada’s national regulatory body. ↩

- The Keystone Xl pipeline was originally designed to travel directly from Hardisty, Alberta, to Steele City, Nebraska. Since the Keystone XL pipeline would cross an international border, presidential approval is needed, stating that the project is in the United States’ national interest. ↩

- Canada Association of Petroleum Producers. “Crude Oil: Forecast, Markets, and Transportation.” (2015). Web. <http://www.capp.ca/publications-and-statistics/publications/264673>. ↩

- Ibid. ↩

- Cryderman, Kelly. “Chinese Arrest Raises Worry over Athabasca’s Dover Deal.” The Globe and Mail. July 2014. Web. <http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/chinese-arrest-former-head-of-petrochinas-canadian-subsidiary/article19639222/>. ↩

- Barry Naughton has written extensively on SASAC; for example: “Profiting the SASAC Way,” China Economic Quarterly (2008): 19–26; “SASAC and Rising Corporate Power in China,” China Leadership Monitor 24 (2008); and “Claiming Profit for the State: SASAC and the Capital Management Budget,” China Leadership Monitor 18 (2006). ↩